As the story goes, Adam's lust dead-ended in shame, with Adam and Eve dressing in fig leaves and exiled from Paradise for the rest of eternity.

Snow White went comatose after her tainted bite.

Fortunately, things aren't quite as harsh for Apple, Inc.'s investors, as it was for Adam and Snow, even though they're being forced to live in a post-Jobs world.

But it may be time to quit biting the apple, regardless. After all, not everyone can expect a Prince Charming awakening from their Apple-induced slumber.

While I'm in the minority with my advice, at least I'm not the only one saying it's time to quit biting.

According to the 3/1/14 Wall Street Journal, just 69% of Wall Street's analysts rate APPL a "Buy," versus 94% in September, 2012. In fact, several institutional investors and major funds are at their lowest levels of Apple stock holdings in 5 years.

The following three signals caused my "Quit Biting the APPL" recommendation, and/or advice to at least begin shedding some of your investment, if you're in too deep for an abrupt exit.

1) To increase Earnings per Share, Apple's manipulating the financial factors that affect EPS and/or share price (stock buyback program, increasing cash dividends), rather than actually increasing earnings or shareholder value.

2) Apple is also, albeit somewhat stealthily, trying to M & A their way out of the creativity void caused by the loss of Steve Jobs. In the past year, they've outspent Google, becoming the top purchaser of tech businesses.

3) Apple's CEO, Tim Cook, and the board of directors believe their best strategy for what to do with the $147 billion in cash they've accumulated is to give the money back to shareholders.

The primary reason I find the above signals so alarming is they indicate Apple doesn't have another "Next Big Thing" they're planning to unveil anytime soon.

If Apple had another major innovation in the pipeline, like the Macintosh computer, the iPod, iPhone and even iPad - something that'd really change the way we live - they'd need the billions of dollars in cash stockpiles for the massive product launch. If they had such a life-changing invention on the way there's no way their board would be rushing to hand a cash surplus back to shareholders via record dividend payments. And, activist investors like Carl Icahn, wouldn't be demanding cash back, either.

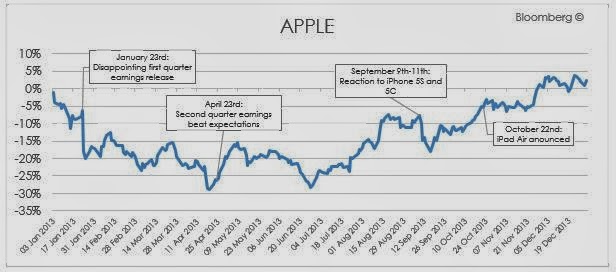

As you can see in the above Bloomberg chart, Apple hasn't had a major innovation (just cool line extensions) since the launch of the iPad in 2010 - when Steve Jobs was still alive and kicking!

If the next best device was about about to be unleashed on all of us, Apple wouldn't have to be on such a huge acquisition spree, trying to buy their next greatest invention from outside their company.

Apple's M & A trend concerns me for several other fundamental reasons. Is Apple, Inc. becoming a tech holding company? How much experience do they have integrating acquisitions? Pre-2013, they only did a few small acquisitions here and there.

Already Tim Cook has the reputation of managing by the numbers (financial statement performance) instead of by the gut - which was his predecessor's purported management style and one that is common among entrepreneurial geniuses.

In my experience, one of the fastest ways to kill creativity in a company is to put the numbers people in charge.

Still, if it weren't for these last concerning developments outlined below, I wouldn't be so strong in my 'Quit Biting the APPL' stance.

I'm not sure what's up, but something doesn't seem quite right in Paradise.

A couple of years ago, Warren Buffett, who doesn't own any Apple stock, publicly recommended to Steve Jobs that Apple should launch a share buy back program, if he thought the stock was undervalued.

Allegedly, Jobs replied that he did consider Apple's stock to be underpriced, but he didn't end up following Buffett's buyback advice.

Post Jobs, in 2013, activist investors, like Carl Icahn, and hedge fund managers like David Einhorn, started demanding Apple do something productive with their massive cash reserves.

So Apple hired Goldman Sachs, (whose major shareholder is Warren Buffett's Berkshire Hathaway investment behemoth), to consult with their board to determine the best strategy for using Apple's $147 billion in cash reserves.

The following 'brilliant' financial strategy emerged as a result:

1) Launch a stock buyback plan. This maneuver boosts earnings per share because there are less shares outstanding over which to spread the company's earnings.

2) Return cash to shareholders via aggressive dividends. The increase in dividends will hopefully allow APPL to maintain its position in the portfolios of the major pension funds and institutional investors that own the majority of Apple's stock.

So far, so good - at least on paper. But here's what really bugs me:

For some unexplained reason, even though Apple's stock buybacks and dividend increases are allegedly about proactively reducing the company's $147 billion cash stockpile, Apple floated a record bond offer of $17 billion.

If Apple was doing the dividend increase and stock buyback program because it has so much excess cash, as the party line would have us believe, why borrow money (via the bond offering) to fund the payouts?

- This sounds like something an investment bank would do - NOT a technology rock star!

- So, other than generating a bigger paycheck to Goldman Sachs for their management of the bond offering, in addition to their board advisory services, what was the point?

1) Borrowing cash to pay shareholders' dividends is a classic financial game played by companies in decline who're looking to prop up their share price;

2) Regardless of the amount of cash on hand, borrowing money usually signifies an anticipated cashflow shortfall on the horizon; and

3) Using stock buyback plans as a 'best use of cash' strategy often means one or more of the following effects exist caused by corporate conglomerate malaise taking over a once innovative company - driving it down from great to good.

- The company has no better ideas about what it could be developing, producing, or creating with the cash - therefore, there are better investments elsewhere and they're returning the cash/capital to their investors to let them spend it elsewhere.

- The company hopes to trigger short-term stock price increases by boosting Earnings per Share via spreading the same earnings over less outstanding shares, rather than actually increasing earnings to boost EPS numbers.

I guess there's nothing wrong with settling for good, especially if you doubt your ability to be great. However, the problem with APPL's share price is that it's still priced for greatness, and the company is no longer as well-poised to deliver it. Although their stock didn't really take a major hit when Steve Jobs died, the loss of his creative genius did cause a huge void right at the core of Apple, Inc. In nature, any apple without it's core will eventually rot and cave in on itself. The same will be true for this corporate powerhouse unless it finds a way to fill the void with a new creative lifeline, and do it quickly.

- I do agree the entrepreneurial talent acquisition spree Apple has been on is probably their best bet to fill the void.

- It's simply that any M & A strategy is just that - a pretty expensive, unproven gamble.

Consider it to be 'Giving up something for Lent," even if you're not Catholic.

Plus, if you shift your investment elsewhere,

you're bound to find a tastier choice . . .

Which is not that hard to do, given APPL's stock only appreciated 2% in 2013.

Your new investment choice could be one you'd never have found

If you kept on biting the same old overpriced Apple everyone else is still chewing on.

In closing, here's an oldie but a goodie, from the old Apple Records - The Beatles live, performing "I'm Looking Through You." Thank God for YouTube!

Ciao for Now,

Sera

Macintosh